Digital Wallets: Unlocking Growth Opportunities Across Industries

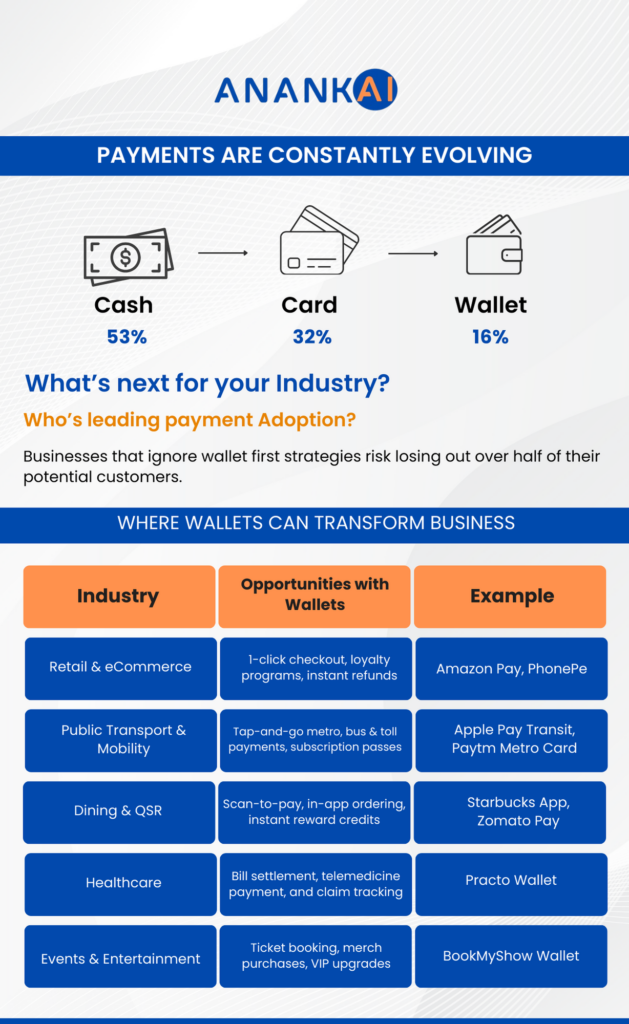

The way we pay has evolved quickly from cash to cards and now to digital wallets. Today, over 50% of online transactions happen through wallets, making them the most preferred payment option.

For businesses, this shift is more than a technology upgrade. It’s an opportunity to create seamless experiences, gather better data, and drive revenue in ways that weren’t possible before.

The Market Reality

- 16% of payments are still made in cash (Source: Pay Space)

- 32% use cards (Source: Pay Space)

- 53% now happen through digital wallets (Source: Capital On Shopping)

This change is too significant to ignore. Customers expect quick, secure, and flexible payments, and wallets deliver exactly that.

Opportunities and Use Cases by Industry

Wallet adoption opens up new ways to engage customers across multiple sectors.

- Retail & eCommerce

Use Case: One-tap checkout with integrated loyalty points.

Impact: Lower cart abandonment, higher repeat purchases.

- Public Transport & Mobility

Use Case: Tap-to-pay at metro stations or buses.

Impact: Faster boarding, reduced cash handling, better route data.

- Dining & Quick Service Restaurant (QSR)

Use Case: Scan-and-pay at the table or in-app pre-order and pay.

Impact: Quicker table turnover, higher customer satisfaction.

- Healthcare

Use Case: Digital bill settlement and instant teleconsultation payments.

Impact: Reduced wait times for patients and smoother admin processes.

- Events & Entertainment

Use Case: Wallet-based ticket booking and cashless food stalls at events.

Impact: Shorter queues, higher on-site spend, better customer experience.

- Travel & Hospitality

Use Case: Contactless hotel check-in, room upgrades, and local currency-free payments.

Impact: Better guest experience, upselling opportunities.

- Banking & Fintech

Use Case: Wallet-powered onboarding with KYC/KYB and recurring payments.

Impact: Faster account activation and frictionless transactions.

Energy & Utilities

Use Case: Wallets for EV charging stations and automatic bill payments.

Impact: More consistent collections and improved customer convenience.

Emerging Trends to Watch

Businesses that adopt wallets now will be ready for what’s next:

- Multi-currency and crypto support to cater to a wider audience

- Loyalty and reward integration directly inside the wallet

- Real-time data insights to drive personalisation and targeted campaigns

By making wallets part of the payment strategy, businesses can:

- Reduce checkout friction

- Improve trust with secure transactions

- Lower payment processing costs

- Gain insight into customer behaviour to guide marketing and operations

How AnankAI Helps

AnankAI offers everything businesses need to launch a wallet-first experience:

- White-label wallet apps to go live quickly under your own brand

- Support for both fiat and crypto transactions

- Instant, secure transfers for B2B, B2C, and P2P

- Simplified KYC/KYB onboarding to accelerate adoption

- Built-in analytics to understand customer spending and loyalty

For a detailed discussion about the digital wallet, write to us at info@anankai.com.

Conclusion

Digital wallets are no longer a future trend; they’re the present reality. Businesses that embrace them are finding new ways to engage, sell, and build stronger customer relationships.

The question is not if your industry will adopt digital wallets; it’s how soon you will make them part of your growth strategy.